|

DOI: 10.25136/2409-7144.2023.11.68970

EDN: ASCWEA

Received:

10-11-2023

Published:

17-11-2023

Abstract:

This article is dedicated to elaboration and testing of a methodology for assessing the effectiveness of state information policy in the field of increasing the level of public trust in financial institutions at the regional level. Based on the practice-oriented concept of state information policy in the field of increasing public confidence in financial institutions, the main theoretical principles and criteria were analyzed. A system of indicators to assess the effectiveness of this state information policy at the regional level was also presented. The conducted cluster and correlation analysis of the regions of the Central Federal District made it possible to rank them according to the level of socio-economic well-being, which allowed us to identify the Lipetsk, Ryazan and Moscow regions as objects for further testing of the elaborated methodology. In the proposed methodology, effectiveness assessment indicators were grouped into four blocks: 1) strategic planning and programming; 2) methodological and personnel support; 3) implementation of information policy; 4) effectiveness of government programs. The application of a methodology for assessing the effectiveness of state information policy measures in the field of increasing public confidence in financial institutions in the regions showed its average level in all three regions we selected. It was concluded that regions should more flexibly and effectively distribute their activities across all components and stages of the implementation of information policy, from planning (including long-term planning) for the implementation of these functions, to organizing monitoring of the effectiveness of ongoing activities.

Keywords:

state information policy, politics’s efficiency assessment, trust, financial institutions, financial market, state program, region, strategic planning, monitoring, control

This article is automatically translated.

You can find original text of the article here.

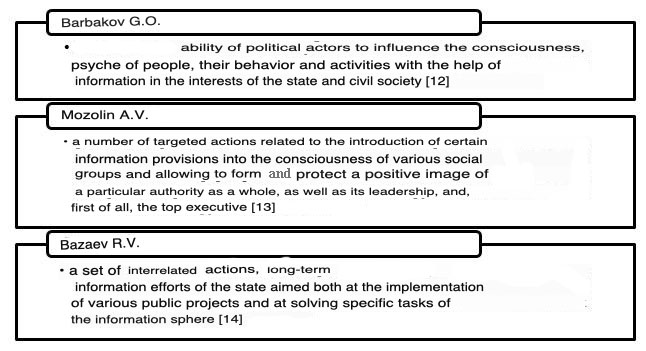

The article was prepared with the financial support of an internal grant from the Financial University within the framework of a project competition for the creation of scientific and educational laboratories in the structure of faculties / branches. Order No. 1833/0 of July 13, 2023 The state continues to be a key actor in the Russian information space. One of the areas where the presence of the state as a key actor in the formation of the information field is particularly noticeable and, we emphasize, is still necessary is the financial market. The development of the Russian financial market in recent years has raised issues of increasing the level of financial literacy of the population for all its participants. At the same time, in the shadow of this topic are issues of increasing the level of trust in financial institutions, far beyond the limits of financial knowledge and requiring an appeal to the transformation of financial culture in Russia. In conditions when the domestic economy is under sanctions and the possibilities of attracting foreign financing are limited, "it is the development of the financial system, the increase in the use of domestic lending, and the active attraction of funds from the population that should contribute to the formation of financial support mechanisms for the structural transformation of the Russian economy" [1]. As Russian studies show, the level of public confidence in financial institutions is heterogeneous by type of organizations, since the level of public confidence in banking and insurance organizations remains relatively stable, while the attitude towards investment and microfinance organizations, as well as non-state pension funds, either decreases or remains at a fairly low level [2, 3, 4, 5, 6, 7]. Taking into account the existing features of public trust that have developed in our country [8], it should be recognized that in many respects the intensity of the processes of formation of trust environments in Russian society and the socio-economic system as a whole depends on the state and the measures it implements within the framework of the state information policy. In these conditions, the implementation of the state information policy in the field of increasing the level of trust in financial institutions is of particular importance. At the same time, it is important not only to develop an appropriate concept [9], but also to implement it effectively, as well as to assess the degree of compliance of the results obtained with the stated goals of this policy. The subject of this article is the development of a methodology for assessing the effectiveness of the state information policy in the field of increasing the level of trust in financial institutions carried out at the regional level. In this paper, we will start from the practice-oriented concept of the state information policy in the field of increasing the level of public confidence in financial institutions, which has already become the subject of research interest [9]. Based on this concept, the authors of this article tried not only to present a theoretical description of the proposed methodology, but also on the basis of correlation and cluster analysis identified a group of regions for its approbation. This allowed us to obtain not only theoretical results, but also to analyze the possibilities of applying the methodology in the context of studying the characteristics of the three selected regions. State information policy in the field of increasing public confidence in financial institutions The activity of the state as an actor of the information space should be based on a long-term system of goals and objectives that determine the main vectors of information policy. Accordingly, the state information policy is aimed at the implementation of these goals and the fulfillment of tasks. It should be noted that there is currently no single well-established approach to determining this direction of public policy (some approaches are presented in Figure 1), however, in general, there are no significant differences in interpretation, which does not complicate the study of this issue. [10]. At the same time, as P.V. Menshikov notes, "the most common among domestic scientists is the definition of state information policy as the ability and ability of policy subjects to influence the consciousness, psyche of people, their behavior and activities with the help of information in the interests of the state and civil society and, in a broader context, as a special sphere of human activity associated with reproduction and the dissemination of information satisfying the interests of the state and civil society, and aimed at ensuring a creative, constructive dialogue between them and their representatives in the interests of realizing the central task of ensuring the constitutional right of citizens to access information" [11].

Fig. 1. Approaches to determining the essence of the state information policy It seems that the condition for achieving this dialogue is the creation of a single open information space with accessible and reliable socially significant information, including contributing to the achievement of long-term goals of socio-economic development of the state, can be considered as the most important task of the state information policy. The solution of this problem will allow to form an information space, the functioning of which will correspond to national interests, and the availability of truthful information will increase public confidence in existing institutions. The concept of "trust" is one of the most complex concepts of modern socio-humanitarian knowledge, since it reflects the values and beliefs of the subject only to a relative extent amenable to theoretical analysis, and more importantly, to sociological measurement. In the broadest sense, trust can be defined as "confidence in the ability to fulfill obligations" [15, p.43]. Another source of the problematic definition of this concept is its interdisciplinary nature, since the problems of trust (personal, network, institutional) are in the focus of several scientific disciplines at once: ethics, psychology, sociology, economics, political science [8].

The concept of "trust", as well as the related concepts of "trust environment" and "culture of trust" correlates with the concepts of "risk" and "loyalty". The concept of "culture of trust" has long been firmly established in scientific circulation, although in some cases it is replaced by the concept of "trust environment", which emphasizes the dynamic nature and specific tools for the formation of a culture of trust (including information openness) [16]. Researchers also talk about the culture of trust in the plural, pointing to the diversity of sources of formation [17] and the multilevel nature of this phenomenon [18]. In our opinion, it makes sense to use both concepts when talking about trusting environments as a prerequisite for the formation of a culture of trust. Currently, the issues of the influence of trust on socio-economic development are studied very widely. Studies have already emphasized that "the level of trust and the degree of public confidence in institutions affects the structure of personal assets, income, trade, the degree of development of entrepreneurship and, in general, the level of development of the financial system" [1]. The above determines the need to develop an appropriate methodology for assessing the effectiveness of the state information policy in the field of increasing the level of public confidence in financial institutions. In our opinion, the key importance for this methodology is played by a system of indicators that would reflect the theoretical and methodological achievements of modern research on the culture of trust, factors and actors of its formation, as well as the most important institutional practices. Description of the methodology for assessing the state information policy in the field of increasing the level of public confidence in financial institutions at the regional level Due to the fact that the state information policy is implemented at two levels: federal and regional, an important direction is to take into account the specifics of the implementation of policy measures at the level of the subjects of the Russian Federation (powers, financial support, planning quality, staffing, etc.), as well as the specifics of the culture of trust in financial institutions that depends on historical, cultural and socio-economic features. A certain challenge facing the task of developing a system of criteria for evaluating the effectiveness of information policy in the field of increasing the level of public confidence in financial institutions is the need to take into account not only the information measures themselves (implementation of information policy), but also taking into account the result of these measures (the level of trust in financial institutions). In this article, we will focus our attention only on evaluating the effectiveness of information policy implementation, since the issues of measuring the level of trust in financial institutions have already become the subject of scientific analysis [3, 6]. Due to the specifics of regional actors and the possibilities of their influence on the information field of the regions, we identified the main directions of the state information policy, within which the practices of various actors (financial organizations, state institutions, educational organizations, mass media and media) could be coordinated, which meant a transition from the evaluation of actors to typological signs of the effectiveness of the implementation of the corresponding direction. It should be noted that "the identification of typological features presupposes, on the basis of quantitative parameters, the establishment of qualitative heterogeneity of regional development, i.e., determining the nature of differentiation by the level of intensification of implemented measures" [19] in the direction of increasing the level of public confidence in financial institutions. With all the existing set of assessment methods, each of which has its advantages and disadvantages, we have developed a methodology for typifying regions according to the level of intensification of the implementation of measures aimed at increasing public confidence in financial institutions, based on previously developed methodological principles for assessing the differentiation of the development of the territories of the region [20]. The proposed evaluation system meets the following characteristics: - reflects the objective parameters of the development of information policy in the field of increasing public confidence in financial institutions at the regional level; - takes into account the stimulating factors of the development of information policy in the region in the field of increasing public confidence in financial institutions; - contains indicators corresponding to the available information base of indicators for the implementation of a set of information policy measures in the field of increasing public confidence in financial institutions in the regions; - applies methods of generalization of indicators that allow unambiguous interpretation of the results at various levels of the evaluation system. For the practice-oriented and effective use of the methodology for assessing the effectiveness of the state information policy of the Russian Federation in the field of increasing the level of public confidence in financial institutions at the regional level, we have taken as a basis a number of methodological principles of information and methodological support:

- the complexity and consistency of the assessment, reflecting various aspects of the level of intensity of the implementation of regulatory measures of information policy in the field of public confidence in financial institutions in the region on the basis of private and integral characteristics; - ensuring the greatest representativeness of indicators that take into account the varying degree of intensity of the implementation of state information policy measures in the field of public confidence in financial institutions in the region; - accessibility for understanding and interpreting the results of assessing the intensity of development of the state information policy in the field of public confidence in financial institutions as a whole, as well as its individual components (tools); - adaptability of the system of applied indicators to the conditions and peculiarities of the development of various territories of Russia. Thus, the indicators used in the proposed methodology correspond to the principles presented above, which determined the departure from the use of indicators of official statistical accounting to the use of indicators of departmental statistics: data from federal and regional executive authorities, as well as data from reporting information and analytical materials, the publication of which is mandatory (for example, reports on the evaluation of the effectiveness of state programs). Indicators for evaluating the effectiveness of information policy implementation in the field of increasing the level of public confidence in financial institutions at the regional level were grouped by us into four indicative blocks reflecting the process of formation and development, provision and implementation of information policy, as well as evaluating the effectiveness of government programs in this area. Indicators, as well as sources for filling in the values of these indicators are presented in Table 1. Table 1 A system of indicators to assess the effectiveness of the state information policy in increasing the level of public confidence in financial institutions at the regional level* | ¹ | Indicator | Data source | | 1. Strategic planning and programming | | 1.1 | Availability of long-term information strategies for the development of financial trust (Indicator value: 3 – the presence of a strategy and a strategy implementation plan; 2 – the presence of a strategy, the absence of a strategy implementation plan; 1 – the presence of a general information policy strategy of the subject, 0 – the absence of sectoral strategies) | Documents of strategic planning of the subject of the Russian Federation (NPA on approval) | | 1.2 | The presence of a priority goal and objectives in the socio-economic development strategy of the region, projects for the development of information policy in the field of financial trust and financial literacy

(Indicator value: 3 – the presence of a goal, task and project, 2 – the presence of a goal, task, 1 – the presence of a goal) | Strategy of socio-economic development of the subject of the Russian Federation (NPA on approval) | | 1.3 | Availability of the state program (structural element of the state program - subprogram) in the field of information policy (Indicator value: 2 – the presence of an independent state program, 1 – the presence of a structural element of the state program) | List of state programs of the subject of the Russian Federation (NPA on approval), NPA on approval of state programs of the subject of the Russian Federation | | 1.4 | Availability of a state program (a structural element of the state program - subprogram) in the field of financial literacy development (Indicator value: 2 – the presence of an independent state program, 1 – the presence of a structural element of the state program) | List of state programs of the subject of the Russian Federation (NPA on approval), NPA on approval of state programs of the subject of the Russian Federation | | 1.5 | Availability of a comprehensive plan to improve the financial literacy of the population of the region, including increasing financial confidence (Indicator value: 1 – the presence of a plan, 0 – its absence) | NPA or the decision of the interdepartmental commission on the approval of a comprehensive plan | | 2. Methodological and personnel support | | 2.1 | The number of supporting educational organizations acting as operators of programs for the development of a culture of financial trust and financial literacy in the region | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 2.2 |

The number of teaching staff in the region who have passed advanced training and retraining in financial literacy (units) | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 2.3 | Number of educational programs in institutions of higher and secondary vocational education aimed at improving financial literacy (units) | Analysis of information about educational programs posted on the Internet | | 2.4 | The number of educational programs of DPO aimed at improving financial literacy (units) | Analysis of information about educational programs posted on the Internet | | 3. Implementation of information policy | | 3.1 | Number of regional state information and communication resources dedicated to financial literacy and financial trust (units) | Materials and data of state authorities of the subjects of the Russian Federation posted on the Internet | | 3.2 | The share of public authorities of a constituent entity of the Russian Federation posting information on the development of financial literacy and financial trust on their official websites (%) | Official websites of state authorities of the subject of the Russian Federation | | 3.3 | Number of broadcasts/videos aired on television and broadcasts/audio clips aired on radio (units) |

Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 3.4 | Number of information messages aimed at informational support of events of other actors (units) | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 3.5 | The number of contests and Olympiads on financial literacy and financial trust organized in the region during the reporting period by institutions of secondary and higher education (units) | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 3.6 | The number of comprehensive measures in the region aimed at developing financial confidence, financial literacy and economic culture (units) | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 3.7 | Number of participants in complex events aimed at developing financial confidence, financial literacy and economic culture (units) | Statistical data on the development of financial literacy in the subjects. Portal Moifinances.rf. URL: https://ìîèôèíàíñû .rf/project/about-us/ | | 3.8 | Number of initiatives and projects for the development of financial literacy and the formation of a culture of financial trust in the subject of the Russian Federation supported by the ARFG (units) | Data from the Association for the Development of Financial Literacy URL: https://fincubator.ru/company/ |

| 4. Effectiveness of government programs | | 4.1 | The share of the achieved target values of the indicators of the state program of the region (a structural element of the state program) in the development of financial literacy (%) | Analysis based on the consolidated annual report on the progress of implementation and evaluation of the effectiveness of the implementation of state programs of the subject of the Russian Federation, reports on the implementation of state programs of the subject of the Russian Federation | | 4.2 | The share of the achieved target values of the indicators of the state program of the region (a structural element of the state program) in the field of information policy (%) | Analysis based on the consolidated annual report on the progress of implementation and evaluation of the effectiveness of the implementation of state programs of the subject of the Russian Federation, reports on the implementation of state programs of the subject of the Russian Federation | | 4.3 | The number of practices in the field of financial literacy development and financial trust formation included in the Catalog of the best regional practices (units) | Directory of best regional practices URL: https://ìîèôèíàíñû .rf/materials/katalog-luchshih-regionalnyh-praktik-2023/ | *developed and compiled by the authors Based on the values of indicators for various subjects of the Russian Federation, it is possible to determine the relative intensity of government measures within the relevant areas of activity measured by indicators and further the intensity of activity within the indicative blocks reflecting the process of formation and development, provision and implementation of information policy in the field of increasing the level of public confidence in financial institutions at the regional level. To determine the level of intensity within a specific indicator, it is proposed to abandon the expert definition of threshold values, taking as a basis the provision on the competitiveness of regions, including in the framework of the implementation of information policy. Therefore, the range of indicator values for determining the intensity level is defined as the arithmetic mean of the difference between the maximum and minimum values of this indicator in the regions of the comparison group. Thus, the defined ranges of indicator values for assessing the intensity of implemented measures will be adaptive and vary depending on factors of an exogenous nature for the subjects of the Russian Federation. Each intensity level is assigned a corresponding score: 1 – low level, 2 – medium level, 3 – high level. Next, the intensity level is determined according to the indicative block, based on the sum of the points scored for the intensity of activity within the indicators and the intensity assessment scale presented in Table 2. Table 2 A scale for assessing the intensity of activity within the indicative blocks of the effectiveness of the state information policy in the field of increasing the level of public confidence in financial institutions at the regional level* |

Indicative block | Number of indicators | Range of points | Intensity level | | 1. Strategic planning and programming | 5 | 0-9 | low | | 10-12 | average | | 13-15 | high | | 2. Methodological and personnel support | 4 | 0-6 | low | | 7-9 | average | | 10-12 |

high | | 3. Implementation of information policy | 8 | 0-15 | low | | 16-20 | average | | 21-24 | high | | 4. Effectiveness of government programs | 3 | 0-4 | low | | 5-7 | average | | 8-9 | high | *Compiled by the authors

The final assessment of the effectiveness of information policy in the field of increasing the level of public confidence in financial institutions is based on the scale presented in Table 3. Table 3 Scale of evaluation of the effectiveness of the state information policy in the field of increasing the level of public confidence in financial institutions at the regional level* | Range of points | Efficiency level | | 0-29 | low | | 30-49 | average | | 50-60 | high | *Compiled by the authors The gradation of scores by levels of effectiveness is based on the approach according to which the effectiveness of the state information policy can relate to an average or high level only if at least 50% of the indicators have an appropriate level of effectiveness or at least 50% of the total score of the corresponding level of intensity of indicators is scored. The use of this methodology allows both evaluating the effectiveness of the subject's information policy as a whole or certain components that determine the process of its formation and development, ensuring and implementing information policy in the field of increasing the level of public confidence, and rating a number of subjects of the Russian Federation on the basis of a point assessment. Cluster and correlation analysis of regions Central Federal District Next, using the proposed methodology, we will evaluate the effectiveness of the state information policy in increasing the level of public confidence in financial institutions in regions with different levels of socio-economic development. We have identified the Central Federal District as a model macro-region. Within this macro-region, it was decided to identify several areas that could become objects for our comparative analysis. To this end, we conducted a cluster analysis of some indicators of socio-economic development of the Central Federal District regions in order to group them according to the level of socio-economic well-being (Table 4). Table 4 Indicators of socio-economic development of the region, characterizing the level of well-being of the population

| Economic indicators | Demographic indicators | | 1. | GRP, million rubles. | 15 | Permanent population as of January 1 | | 2. | GRP per capita, RUB. | 16 | The share of the urban population in the total as of January 1 | | 3. | Average per capita income of the population, RUB. | 17 | Total permanent population growth | | 4. | The amount of the subsistence minimum, rub. | 18 |

Migration population growth | | 5. | The ratio of the average per capita income of the population with the value of the subsistence minimum, in % | 19 | The share of the working-age population in the total population | | 6. | The number of the population with average per capita income below the poverty line (the subsistence minimum), thousand. Person | 20 | The share of the employed population aged 25-64 years with higher education in the total number of employed population of the corresponding age group | | 7. | The level of poverty, in % | 21 | Average life expectancy | | 8. | The level of monetary income of the population, rub. | Deviance indicators | |

9. | The place of the region by the level of monetary income of the population in the Russian Federation | 22 | The level of crime in the economic sphere | | 10. | Share of investments in fixed assets in GRP, in % | 23 | Overall crime rate | | 11. | Labor productivity index, in % compared to the previous year | The level of financial culture and financial literacy | | 12. | Industrial production index, in % compared to the previous year | 24 | Level of financial knowledge | | 13. | Average monthly nominal accrued wages of employees in the economy as a whole, RUB |

25 | The level of financial behavior | | 14. | The share of food purchase expenses in the structure of household consumer spending | 26 | Financial installations | The use of such a criterion as socio-economic well-being when ranking regions is justified due to the importance of the level of socio-economic well-being for the circulation of all forms of capital and the relationship between the population and public institutions. The well-being of the population in this study is understood as the provision of the population with all the necessary benefits, creating conditions for a calm, comfortable and sufficient life. "Well-being is close in meaning to comfort, wealth, contentment, affluence, prosperity, security, prosperity, prosperity, wealth, happiness, luck, pleasure, success, etc." [21]. The achievement of a certain (low, medium and high) level of well-being by the population indicates that economic, social, political and other conditions have been created in this territory for different levels of comfort of life and professional activity of a person. In these conditions, in our opinion, the degree of readiness of the population to support the initiatives being undertaken at the state level is largely related to the level of socio-economic well-being in the region, which directly reflects satisfaction with the conditions for life and work created by the regional authorities. Against this background, trust can be formed in the main political, economic, financial and other institutions at both the federal and regional levels, which are designed to solve various types of tasks. Research shows [21] that public confidence is largely rational and based on awareness of the effectiveness of the policy pursued by the authorities. Consequently, there is reason to assume that the level of socio-economic well-being of the population of the region is closely related to the level of public confidence in the institutions of state power, as well as regional peculiarities of financial literacy [23]. Most researchers closely associate the concept of the quality of life of the population with well-being. Thus, Professor of the Financial University Zubets A.N. defines the quality of life as "the level of happiness of people, or the degree of their satisfaction with their lives, as well as objective indicators of well-being, such as life expectancy, income, education, and so on" [22]. He also notes that "the measurement of the quality of life is based on two main types of indicative indicators of the quality of life: objective (economic, demographic, social, natural); subjective (assessments of the satisfaction of the population with the quality of their life in various spheres)" [22]. In this regard, within the framework of this study, the following objective indicators for assessing the quality of life were selected – indicators of socio-economic well-being of the population: - material well-being (economic indicators), - social well-being (demographic indicators), - psychological well-being (indicators of deviance), - financial well-being (indicators of the level of financial culture and literacy). A distinctive feature of our approach to assessing the level of socio-economic well-being is the presence of indicators of financial literacy and financial culture in it, which, in our opinion, are an important component of the formation of favorable conditions for increasing the level of economic well-being, involvement of the population in the processes of personal financial investment and financial independence (solvency). The increase in the level of financial culture and literacy creates prerequisites for the formation of a favorable trust environment for financial institutions, which reflects the subjective side of the formation of the population's satisfaction with the quality of their lives and collectively characterizes a certain level of the quality of life of the population in a particular region.

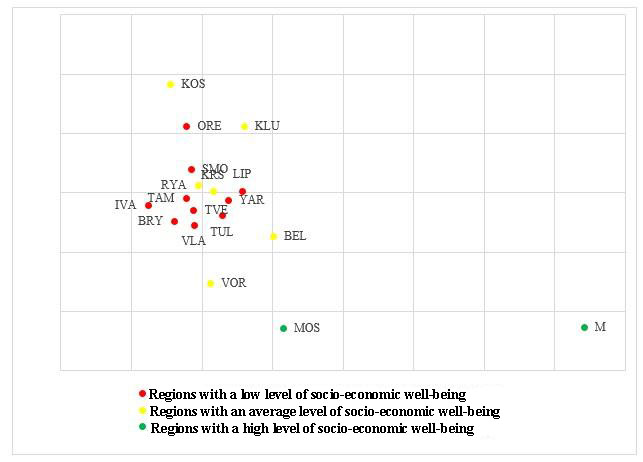

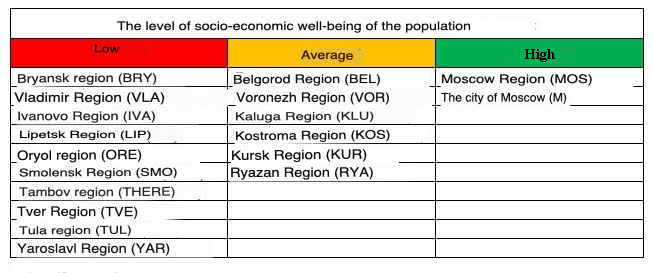

Thus, as noted above, the level of socio-economic well-being (quality of life) of the population of the region is related to the level of public confidence in public institutions, including financial institutions. In this regard, in order to determine the level of well-being of the population of the regions of Russia, 26 indicators of socio-economic development of the regions were identified within the framework of this study, grouped into 4 groups (economic, demographic, deviance indicators, indicators of the level of financial culture and literacy). Based on the selected indicators, a cluster analysis was carried out for all regions of the Central Federal District, which made it possible to identify for each block of indicators (economic, demographic, deviance indicators, indicators of the level of financial culture and literacy) groupings of regions according to the degree of their manifestation: high, medium and low. Further, based on the results of cluster analysis, the level of correlation of indicators was assessed, which made it possible to more accurately select the regions characteristic of their group. According to the results of the correlation analysis, it was found that the following indicators have the strongest influence on the level of contributions of the population: - Gross regional product; - The level of economic crime per capita; - The share of the urban population in the total as of January 1; - Total permanent population growth; - Migration population growth. According to these indicators, a final cluster analysis was carried out, according to which, taking into account all 4 data blocks, the regions were distributed as follows (Fig. 2, Table 5).  Fig.2. Cluster analysis of the Central Federal District regions by the level of socio-economic well-being* *Calculated by the authors Table 5 Results of correlation analysis based on cluster analysis of the Central Federal District regions to assess the level of socio-economic well-being of the population*

In the study , cluster analysis served as a tool for classifying the regions of the Central Federal District into three groups: - with a high level of socio-economic well-being (quality of life); - with an average level of socio-economic well-being; - with a low level of socio-economic well-being. The next step of our research is to apply the developed methodology to various groups of regions in the context of cluster and correlation analysis. Approbation of the methodology for assessing the effectiveness of the state information policy in the field of increasing public confidence in financial institutions For the purposes of our further analysis, we selected one region from each group. These regions included the Lipetsk Region (low level), the Ryazan region (medium level), the Moscow Region (high level). The main purpose of this sample is the possibility of conducting a comparative analysis of the intensity of state information policy measures (evaluating the effectiveness of the process) against the background of an appropriate level of socio-economic well-being in the region. Information on the values of the indicators and the assessment of the level of effectiveness of the activities of the authorities for the indicators are presented in Table 6. Table 6

The values of indicators of the effectiveness of information policy in the field of increasing the level of public confidence in financial institutions and the level of effectiveness for comparison regions for 2021* | ¹ | Indicator | Lipetsk region | Ryazan region | Moscow oblast | | 1. Strategic planning and programming | | 1.1 | Availability of long-term information strategies for the development of financial trust | 0 (low) | 0 (low) | 0 (low) | | 1.2 | The presence of a priority goal and objectives in the socio-economic development strategy of the region, projects for the development of information policy in the field of financial trust and financial literacy | 0 (low) | 0 (low) | 0

(low) | | 1.3 | Availability of the state program (structural element of the state program - subprogram) in the field of information policy | 1 (high) | 0 (low) | 1 (high) | | 1.4 | Availability of the state program (structural element of the state program - subprogram) in the field of financial literacy development | 1 (medium) | 2 (high) | 0 (low) | | 1.5 | Availability of a comprehensive plan to improve the financial literacy of the population of the region, including increasing financial confidence | 1 (high) | 1 (high) | 1 (high) |

| 2. Methodological and personnel support | | 2.1 | The number of supporting educational organizations acting as operators of programs for the development of a culture of financial trust and financial literacy in the region (units) | 1 (high) | 1 (high) | 1 (high) | | 2.2 | The number of teaching staff in the region who have passed advanced training and retraining in financial literacy (units) | 531 (medium) | 203 (low) | 966 (high) | | 2.3 | Number of educational programs in institutions of higher and secondary vocational education aimed at improving financial literacy (units) | 38 (low) | 33 (low) | 105

(high) | | 2.4 | The number of educational programs of DPO aimed at improving financial literacy (units) | 15 (medium) | 9 (low) | 33 (high) | | 3. Implementation of information policy | | 3.1 | Number of regional state information and communication resources dedicated to financial literacy and financial trust (units) | 1 (high) | 0 (low) | 0 (low) | | 3.2 | The share of public authorities of a constituent entity of the Russian Federation posting information on the development of financial literacy and financial trust on their official websites (%) | *there is no possibility of retrospective data analysis, because advertising banners do not contain information about the date of placement. The indicator is used for the current and subsequent periods | | 3.3 |

Number of broadcasts/videos aired on television and broadcasts/audio clips aired on radio dedicated to the development of financial literacy (units) | 71 (low) | 126 (high) | n/a (low) | | 3.4 | Number of publications in print and online media devoted to the development of financial literacy (units) | 647 (low) | 691 (high) | n/a (low) | | 3.5 | The number of contests and Olympiads on financial literacy and financial trust organized in the region during the reporting period by institutions of secondary and higher education (units) | 3 (low) | 3 (low) | 4 (high) | | 3.6 | The number of complex measures in the region aimed at developing financial confidence, financial literacy and economic culture (units) |

1647 (low) | 7783 (high) | 1700 (low) | | 3.7 | Number of participants in complex events aimed at developing financial confidence, financial literacy and economic culture (units) | 155 383 (low) | 223479 (medium) | 271000 (high) | | 3.8 | Number of initiatives and projects for the development of financial literacy and the formation of a culture of financial trust in the subject of the Russian Federation supported by the ARFG (units) | 1 (low) | 3 (high) | 1 (low) | | 4. Effectiveness of government programs | | 4.1 |

The share of the achieved target values of the indicators of the state program of the region (a structural element of the state program) in the development of financial literacy (%) | 100 (high) | 100 (high) | 100 (high) | | 4.2 | The share of the achieved target values of the indicators of the state program of the region (a structural element of the state program) in the field of information policy (%) | 100 (high) | 100 (high) | 100 (high) | | 4.3 | The number of practices in the field of financial literacy development and financial trust formation included in the Catalog of the best regional practices (units) | 2 (high) | 1 (medium) | 0 (low) | *Compiled by the authors Next, we tried to determine the level of performance for the indicative blocks, based on the scale proposed in Table 1. The information is presented in table 7. Table 7

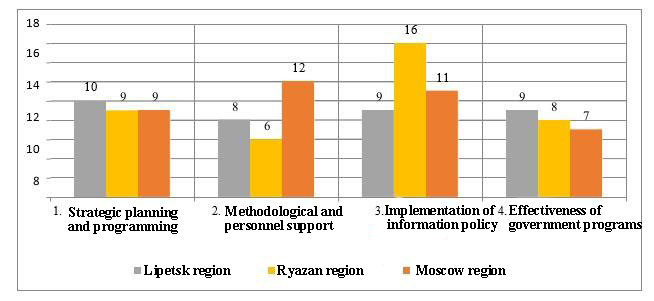

Assessment of the levels of intensity of the activity of the authorities within the indicative blocks of the implementation of information policy in the field of increasing the level of public confidence to financial institutions | Indicative block | Lipetsk region | Ryazan region | Moscow oblast | | 1. Strategic planning and programming | 10 (medium) | 9 (low) | 9 (low) | | 2. Methodological and personnel support | 8 (medium) | 6 (low) | 12 (medium) | | 3. Implementation of information policy | 9 (low) | 16 (medium) |

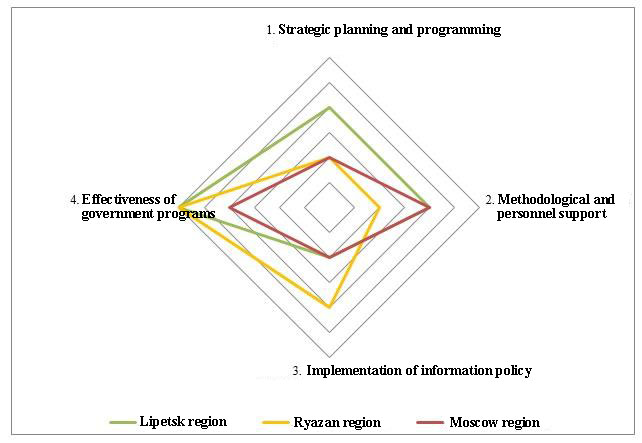

11 (low) | | 4. Effectiveness of government programs | 9 (high) | 8 (high) | 7 (medium) | *Compiled by the authors Graphically, the data obtained are presented in Figure 3. Based on the available data, it can be noted that more intensive achievement of indicator values in the Lipetsk region is characteristic of strategic planning and programming blocks, as well as indicators of the effectiveness of state programs. It should be noted that in the Ryazan region, the main emphasis is on the implementation of measures, which provides the subject with a significant quantitative gap from other regions, but at the same time there is a significant lag in the indicators of the methodological and personnel support unit. The Moscow region has the lowest point value in the block of program effectiveness.  Fig. 3. Comparison of regions by point intensity estimates in the context of indicative blocks *Compiled by the authors Figure 4 shows a petal diagram reflecting the distribution on a three–point scale of performance levels "low – medium - high", which characterizes the unevenness and concentration of efforts of public authorities to implement information policy.  Fig. 4. Concentration of regional efforts in the implementation of information policy in the field of increasing the level of public confidence in financial institutions *Compiled by the authors Further, on the basis of the scale of evaluation of the effectiveness of public policy presented in Table 3, the following assessment of the effectiveness of the state information policy of the regions of comparison in the field of increasing the level of public confidence in financial institutions was obtained: - Lipetsk region (36 points) – average level of efficiency; - Ryazan region (39 points) – average level of efficiency; - Moscow region (39 points) – average level of efficiency. So, the approbation of the methodology made it possible to analyze and evaluate the intensity of the implementation of information activities in three selected regions that differ in the level of socio-economic well-being. However, as we noted earlier, in this article we have considered only one of the aspects of evaluating the effectiveness of information policy related to information events in the regions. A promising step for the next study is to compare these regions by the level of public confidence in financial institutions, which would allow us to see how much the level of socio-economic well-being and the intensity of state information policy measures have an impact on public confidence.

Thus, this article was devoted to the development and testing of a methodology for assessing the effectiveness of state information policy in the field of increasing public confidence in financial institutions at the regional level. In this article, our attention was paid only to the evaluation of the effectiveness of the implementation of information policy. Based on the practice-oriented concept of the state information policy in the field of increasing public confidence in financial institutions, the main theoretical principles and criteria of this methodology were analyzed, and a system of indicators was presented to assess the effectiveness of this state information policy at the regional level. The cluster and correlation analysis of the Central Federal District regions made it possible to rank them according to the level of socio-economic well-being, which allowed us to identify the Lipetsk, Ryazan and Moscow regions as objects for further testing of the developed methodology. The application of the methodology for assessing the effectiveness of state information policy measures in the field of increasing public confidence in financial institutions in the regions showed its average level in all three selected regions. The conducted efficiency assessment showed certain shortcomings in the organization and implementation of the state information policy of the regions associated with excessive concentration of efforts on selected areas or insufficient differentiation of policy components. It should be noted that the significant typification of activities carried out within the framework of information policy does not always allow taking into account the peculiarities of the trust environment and the level of financial trust in the subjects. Regions should allocate their activities more flexibly and effectively to all components and stages of information policy implementation, starting from planning (including long-term planning) the implementation of these functions, ending with the organization of monitoring the effectiveness of the activities carried out.

References

1. Nazarenko, V. S. (2023). State information policy of increasing public confidence in financial institutions as a factor of stimulating economic growth. In: The interaction of government, business and society in a new reality. M.A. Gurina, T.I. Liberman (Eds.) (pp. 224-230). Voronezh: RANEPA.

2. Trust in banks, insurance companies and NPFs has significantly decreased [Electronic resource]. Access mode: https://nafi.ru/analytics/doverie-bankam-strakhovym-kompaniyam-i-npf-zametno-snizilos/

3. Lavrushin, O.I. (Ed.) (2021). Trust in financial market participants: models of its assessment and improvement in the conditions of digital transformation. Moscow: Knorus Publishing House.

4. Linchenko, A.A., Trutenko, E.V., Chernyshova, K.S., & Gulyaeva, A.D. (2021). Trust in financial institutions among young people: the experience of regional empirical research. Russian Economic Bulletin, 4(6), 65-72.

5. Trust in financial organizations has decreased [Electronic resource]. Retrieved from https://nafi.ru/analytics/doverie-finansovym-organizatsiyam-snizilos/

6. Kuzina, O.E., Ibragimova, D.H. (2010). Trust in financial institutions: empirical research experience. Public opinion monitoring: economic and social changes, 4(98), 26-39.

7. Public Opinion Foundation [Electronic resource]. Access mode: https://fom-gk.ru/

8. Trutenko, E.V., Linchenko, A.A. (2021). Problematic field of studying public trust: content analysis of scientific publications. Sociodinamika, 12, 42-55.

9. Linchenko, A.A., Smyslova, O.Y., & Trutenko, E.V. (2023). Practice-oriented concept of state information policy as an institutional basis for increasing public trust in financial institutions of the Russian Federation. Alma Mater, 9, 90-98.

10. Nesterova, N.N., Smyslova, O.Y. (2022). State information policy in new conditions of development of modern society. EFO: Ekonomika. Finance. Society, 1, 6-18.

11. Menshikov, P. V. (2017). Evolution of state information policy in Russia. International communications, 4. [Electronic resource]. Retrieved from https://intcom-mgimo.ru/2017/2017-04/state-information-policy-of-russia.

12. Barbakov, G.O., Kurashenko, I.A., & Ustinova, O.V. (2015). Information policy of local authorities. Modern problems of science and education, 1.

13. Mozolin, A.V. (2012). Report on the results of the study «Information policy of authorities» [Electronic resource]. Retrieved from http://www.rcanalitik.ru/vlast/publikacii_pro_vlast/informacionnaya_politika_organov_vlasti_rezul_taty_issledovaniya.

14. Bazaev, R. V. (2008). National ideology as the basis of the information policy of the state. Izvestiya Saratov University, 1.

15. Ivanov, V.V., Kanaev, A.V., Sokolov, B.I., & Topver, I.V. (2007). Theories of credit. Saint-Petersburg: St. Petersburg University Publishing House.

16. Nurmukhametov, R.K., & Novikova, T.R. (2019). Some issues of the formation of a trust environment in the financial market. Relevant issues of modern economics, 1, 306-316.

17. Marty Martin, E. (2010). Building cultures of trust. Grand rapids. Dordt College: William B. Eerdman’s publishing Co.

18. Kozlova, O.N. (2015). Cultures of Trust: the experience of sociological analysis. Proceedings of the St. Petersburg University of Culture, 208(2), 157-167.

19. Linchenko, A.A., Smyslova, O.Y., & Lakomova, D.V. (2020). Assessing the efficiency of language policy as an institutional framework of economic policy in the Russian Federation. Sociodinamika, 11, 1-27.

20. Smyslova, O.Y. (2016). Strategy of socially oriented development of rural territories: Ph.D. (habil.) diss. VGAU.

21. Guzavina, T.A. (2014). Trust and its role in the region’s modernization development. Economic and social changes, 5(35) https://cyberleninka.ru/article/n/doverie-i-ego-rol-v-modernizatsionnom-razvitii-regiona

22. Zubec, A.N. (2020). Russian and international approaches to the quality of life measurement. Retrieved from http://www.fa.ru/science/index/SiteAssets/Pages/Zubets_Pubs/LQ_B_2020.pdf

23. Smyslova, O.Y., Lakomova, D.V., & Trutenko, E.V. (2022). City dwellers’ financial literacy in regional dimension. Humanitarian Research of Central Russia, 3(24), 73-86.

Peer Review

Peer reviewers' evaluations remain confidential and are not disclosed to the public. Only external reviews, authorized for publication by the article's author(s), are made public. Typically, these final reviews are conducted after the manuscript's revision. Adhering to our double-blind review policy, the reviewer's identity is kept confidential.

The list of publisher reviewers can be found here.

The subject of the peer-reviewed study is a methodology for evaluating the effectiveness of the state information policy in the field of increasing the level of trust in financial institutions implemented at the regional level. The authors rightly associate the high degree of relevance of the topic of his research with the problem of financial literacy of the Russian population, the importance of which has increased dramatically in the context of sanctions restrictions, since the inability to attract foreign capital required the reorientation of the Russian economy to domestic lending and attracting financial resources from its own population. And this, in turn, has exacerbated issues of public confidence in financial institutions, as well as ways to legitimize them through state information policy. It is precisely this practice-oriented concept of state information policy, developed in the works of Russian scientists, that has become the theoretical basis of the peer-reviewed study. On this basis, the task was set to develop and test a methodology for evaluating the effectiveness of state information policy in the field of increasing citizens' trust in financial institutions. The Central Federal District was chosen as a model macroregion for analysis, and cluster analysis of some socio–economic indicators of the well-being of the region's population was used as the main methods; on this basis, a subsequent correlation analysis of these indicators was carried out in order to rank the regions into three groups depending on the level of socio-economic well-being of the population. This made it possible to identify and assess the level of intensity of information activities in the studied regions of the Central Federal District and to test the author's methodology for evaluating effectiveness. Accordingly, there is a scientific novelty in the reviewed work, which consists not only in a practice-oriented methodology for evaluating the effectiveness of state information policy, but also in some conceptual results in the development of this methodology. Structurally, the reviewed work also makes a very positive impression: its logic is consistent and reflects the main stages of the research. In the introductory part of the article, the authors set the scientific task and goals of the work, substantiate the relevance of the chosen topic, subject and research methods. Then the conceptualization of the problem of state information policy in the field of increasing the level of trust in financial institutions is carried out, a methodology for evaluating the effectiveness of such a policy is described, and then this methodology is actually tested. In the final part, the results of the study are summarized, conclusions are drawn and prospects for further research are outlined. The style of the reviewed work is scientific and also does not cause significant complaints. There are some stylistic features in the text (for example, the repetition of words in sentences: "The state continues to be a key actor ... The presence of the state as a key actor..."; "... The level of public confidence in financial institutions is heterogeneous ... because the level of public confidence..." etc.; pleonasm: "... It is especially noticeable and, we emphasize, it is still necessary..."; etc.) and grammatical (for example, the absence of a second comma when isolating a subordinate clause: "In conditions when the domestic economy is under sanctions and the possibilities of attracting foreign financing are limited "it is the development of ..."; or a missing comma when isolating a comparative There are errors in the phrase "such as ..." in the sentence "The use of such a criterion as socio-economic well-being..."; etc.), but in general it is written quite competently, in good language, with the correct use of scientific terminology. The bibliography includes 23 titles and adequately represents the state of research on the subject of the article. An appeal to opponents takes place when discussing the practice-oriented concept of state information policy. The advantages of the article also include rich illustrative material (4 figures and 7 tables), which significantly facilitates the perception of the authors' arguments and conclusions. GENERAL CONCLUSION: the article proposed for review can be qualified as a scientific work that meets all the requirements for works of this kind. The results obtained by the authors are sufficiently reliable and justified, have signs of scientific novelty and correspond to the subject of the journal "Sociodynamics". These results will be of interest to political scientists, sociologists, specialists in the field of public and municipal administration, as well as to students of the listed specialties. According to the results of the review, the article is recommended for publication.

Link to this article

You can simply select and copy link from below text field.

|